NexeArt Capital

Democratize investment in the art market as part of an asset diversification strategy

Creator of Choices and Solutions of Investment and Financing in Art for Individuals and Companies

NexeArt Capital is a company that specializes in Investment and Financing in the art market. It advises and accompanies you in the constitution, private management and financing of your artistic assets and co-creates your choices and investment solutions in Art according to your patrimonial objectives both in terms of time and the amount to be invested.

There are an infinite number of questions to be answered when purchasing a work of art.

Which artist ? What means? What period? What scale? Is the price right? What are your acquisition objectives (investment, holding, IRR, capital gain, patrimonial investment) ?

By combining the best of asset finance, expertise in contemporary art and financing (leasing) of works of art within its management team, the NexeArt Capital team aims to :

Understand your tastes, identify your preferences and adapt to your financial or patrimonial constraints.

Help you access the best works of art available on the market at more attractive prices than in galleries and auction houses, thanks to our control of the end-to-end chain: sourcing, authentication, purchase and resale through a single intermediary.

Define a purchasing strategy and select the best works that reflect your personal interest and your patrimonial objectives (tax, I.R.T. target, capital gain, diversification objectives). Short, medium or long term investments.

For companies and liberal professions, Art Galleries, finance your acquisitions and those of your clients with our NexeArt Leasing solution.

The Clients of NexeArt Capital

NexeArt Capital maintains a close relationship with its clients, new or experienced collectors and investors, and their financial, legal and estate advisors. We meet our clients’ objectives with the tmost diligence, transparency and confidentiality.

The Investors

The NexeArt Capital team advises all types of investors (new or experienced) who wish to diversify their wealth and allocate part of their assets to the art market.

Our teams are all specialists and experts in art investment, private equity, asset allocation, wealth management and finance.

Our skills are organised around our network, our quality of sourcing, valuation and disposal of works of art combined with an acute expertise in private equity, rate of return on investment and art market taxation. our knowledge and ability to source offers a discount from the time of purchase, which allows us to make a profit from the initial investment, and this profit improves with the length of time the property is held.

Companies

NexeArt Capital assists all companies in acquiring or renting works of art for their premises or for their events.

We study your objectives with you and propose financing solutions adapted to your needs.

Companies benefiting from tax incentives can carry out sponsorship, leasing or financial rental operations.

Wealth Managers / Wealth Advisors / Family Office

NexeArt Capital helps you diversify your clients’ assets. Works of art are tangible assets that evolve on an international market and benefit from attractive taxation in most countries.

We consider them to be an asset in their own right and a relevant investment.

Services

NexeArt Capital offers an end-to-end service to its clients, which it delivers with the utmost respect for independence, transparency and confidentiality.

- Search for ultra-rare works of art accessible on a hidden market

- Support and advice on acquisitions and disposals

- Inventory and expertise of collections

- Tax and financial optimisation

- Transport, storage, restoration, framing, insurance

All these services are clearly invoiced according to your needs through a mission letter drawn up at each request.

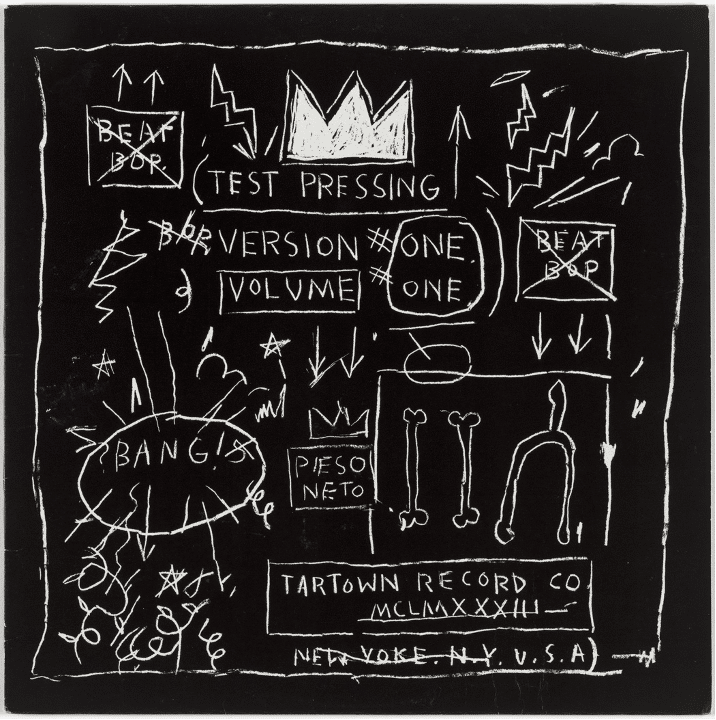

To know and make known the signatures of contemporary artists on which to invest :

« This is our expertise. »

Our references :

Private collections in France and internationally, notably in London, Geneva and New York.